I'm Bitcurious

Time to come out of the geopolitical closet on a controversial topic

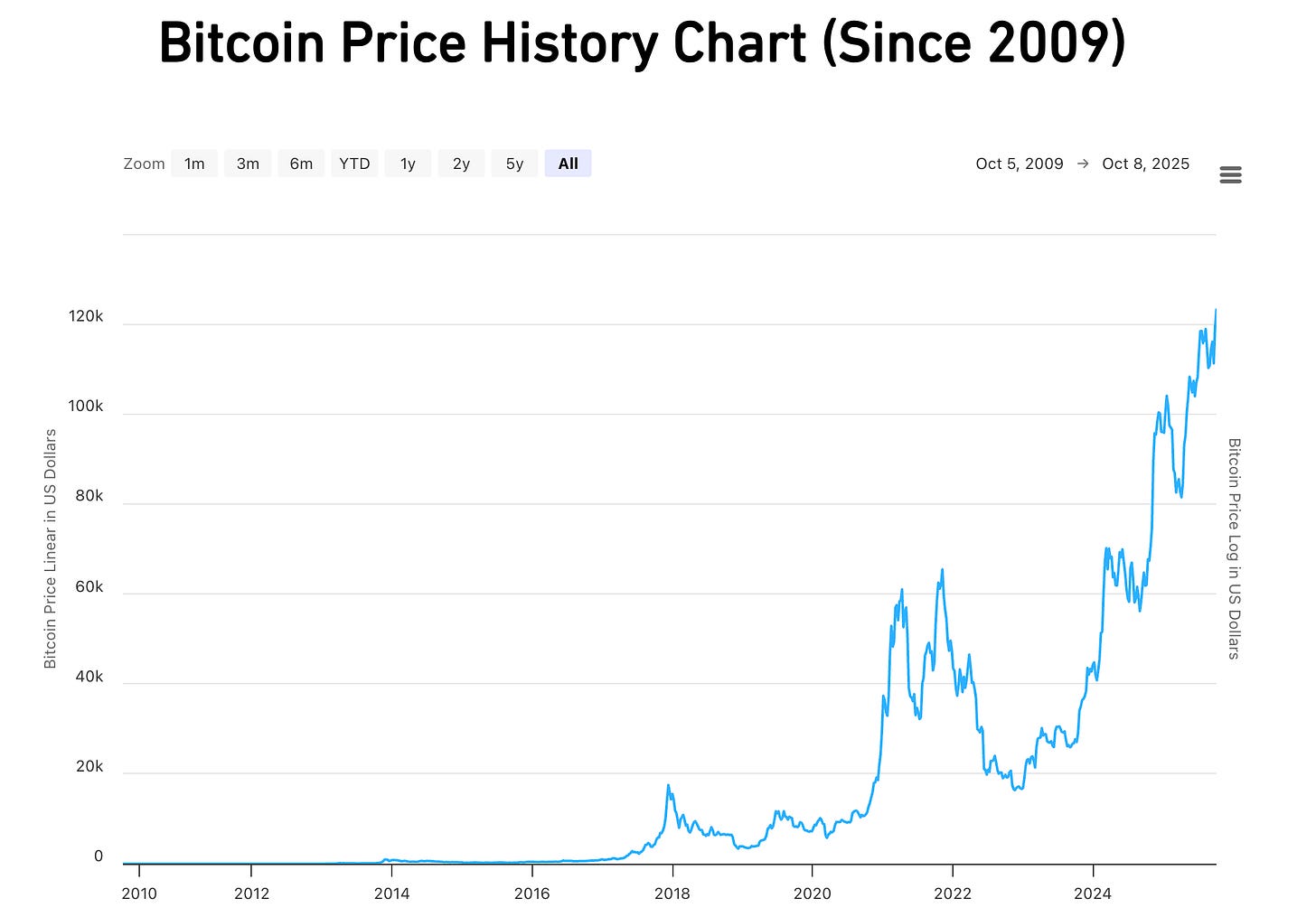

If you’d asked me a few years ago what I thought of Bitcoin, I would have parroted what I learned from my old mentor, George Friedman, who declared in June 2018 that, “At some point [Bitcoin] will become obsolete.”1 I hope I wouldn’t have gone as far as my former Stratfor colleague, Peter Zeihan, who went on Joe Rogan’s podcast in January 2023 and declared: “There’s no intrinsic value to this asset. What’s Bitcoin at? It’s at $16,000, it has another $17,000 to go. There is no intrinsic value to this.”2 (If I had YOLO-ed my personal savings into Bitcoin at either of those moments, I’d be extremely wealthy.) Now, in my position at The Bespoke Group, I find myself working for and with “Bitcoiners,” which has me a) kicking myself on not focusing on Bitcoin earlier, and b) wondering if Bitcoin’s atmospheric rise is still in its infancy.

Like George and Peter, I am a geopolitical analyst. Geopolitics locates the true origin of the baser parts of human nature in the constraints imposed upon us by geography. By studying how geography shapes human communities, geopolitics tries to articulate how states will behave toward each other in the global international system. Geopolitics is exceptionally good at this. It is not a coincidence that geopolitics as a discipline developed in continental Europe at the end of the 19th century, when large multi-ethnic European empires were morphing into modern nation-states. Geopolitics is good at predicting the behavior of nation-states because that is what it was designed to do.

It’s also why geopolitics sucked at identifying, predicting, and appreciating the importance of something like Bitcoin.

To wit, geopolitics is not well suited for identifying important new subnational dynamics and actors. George once told me that his biggest analytical mistake was missing the rise of jihadism in the 2000s. Geopolitical analysis could not imagine the rise of al-Qaeda and a jihadist/anti-modern reaction to the U.S. unipolar world order, where we all thought everybody wanted to listen to Third Eye Blind and hold hands and wear fanny packs. It didn’t have good radar recognition for that kind of development. In that sense, geopolitical analysis also didn’t have good radar recognition for Bitcoin. In the realm of geopolitics, states have a monopoly on power.3 They have guns, laws, and legitimacy. The buck — quite literally — stops with them.

Analysts like George and Peter have a double blindspot in this regard, however. They still reject the notion of the emergence of a multipolar world in favor the ultimate supremacy of U.S. power. As a result, Bitcoin did not (and does not) make sense, because the buck still stops with the U.S. With this worldview, Bitcoin is and must remain confined to a subnational status in a world dominated by a global hegemon that won’t tolerate a significant rival to its fiscal and monetary authority. You can take a more moderate approach like George (i.e., “it’s interesting and maybe useful but not much more than a novelty”) or a radical one like Peter (i.e., IT’S GOING TO ZERO!!!!). But you cannot take Bitcoin seriously if the world is unipolar. It’s a square peg in a round hole.

I parted company with the unipolar thesis after a trip to Moscow in 2019, when I attended a conference at MGIMO and concluded that the world had changed.4 That was the moment I should have taken a much deeper look at Bitcoin, because in a world of rising and falling great powers, of political populism, of a fundamental breakdown in the trust in and legitimacy of legacy political institutions, of rampant government spending to assuage increasingly restless populations, of financial crises like 2008 and shoddy pandemic responses like 2020 and inflationary monetary policy as a last recourse to pay the Pied Piper, Bitcoin makes an awful lot of sense.

I should give myself a little grace and not be too hard on myself. After all, my very first podcast ever — before The Jacob Shapiro Podcast or Cognitive Dissidents — was The Perch Pod, and my first guest was Jeremy Boynton. He was involved in a crypto and blockchain fund. (Of course that is very different than Bitcoin, but I’m just using it as an example of a nascent awareness that I needed to address Bitcoin somehow.) That episode was recorded a week before the COVID lockdowns and published a week after. At the time, Jeremy seemed crazy, and I was skeptical — but still, that was the first podcast I ever did, and it was tangentially about Bitcoin. I was still too dismissive — but I was at least curious enough to listen despite an analytical bias against it.

It took me another year and a half to double click on that conversation, when Garry Golden came on the show, and we did a “What is cryptocurrency?” episode. Garry was/is a hype man for Cardano, and that was the first time I ever bought crypto — some ADA — after the show. (I sold it a year later at 2x and thought I’d done brilliantly. Whoops!) Another year later, Matt Pines came on and was the first person I ever heard connect Bitcoin directly to U.S. foreign policy and geopolitics.5 His point was that if U.S. geopolitics is to continue, the U.S. must have a stance on Bitcoin — that Bitcoin has national security implications.

Two years later, I met Matt McClintock, and I had my first conversation with Matt about Bitcoin and personal sovereignty. Not just sovereignty over currency or assets, but over time, meaning, impact, and focus. That was July 2024 — and even then, I was fundamentally skeptical. At the prospect of working more closely with Matt and Bespoke, one of my chief concerns was over-indexing on Bitcoin — because I still fundamentally doubted Bitcoin’s future. When I would speak at events and get asked afterwards if I owned any Bitcoin personally, I’d get a sheepish look on my face and punt, because I didn’t.

But somewhere between Liberation Day and the U.S. government’s growing comfort with chaos, I started to wonder if the buck still stops anywhere at all, and to my wife’s astonishment, if I shouldn’t divert a significant chunk of my own assets into Bitcoin. It wasn’t just the second Trump administration’s policies that led me to that moment — though sweeping tariffs, a ~10% ytd decline in the value of the U.S. dollar, assaults on Federal Reserve independence and the collective of economic statistics at the BLS didn’t help.

But what Liberation Day really did — and the Trump administration has done — is significantly accelerated the global shift toward multipolarity and an attendant breakdown in confidence in the old fiscal and monetary order.

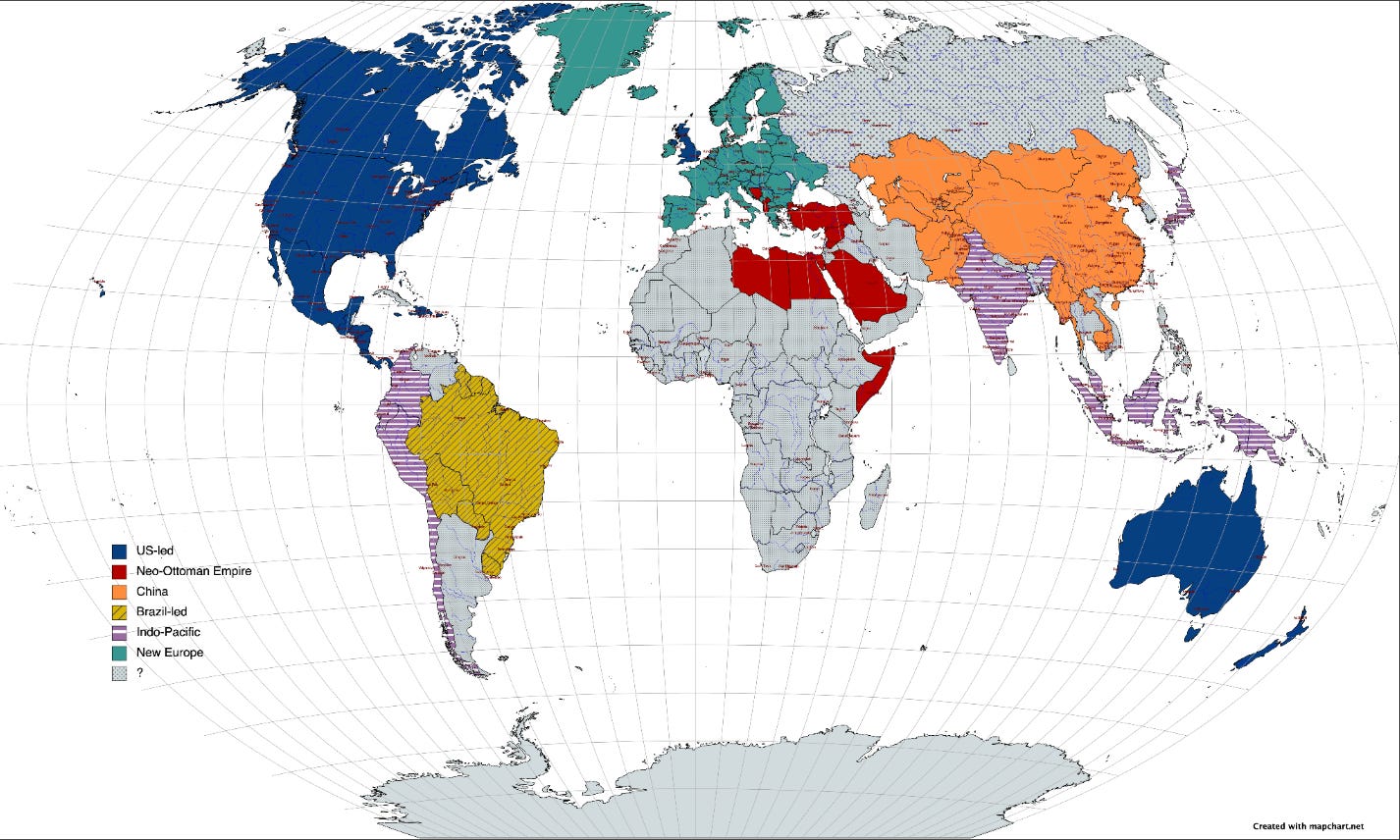

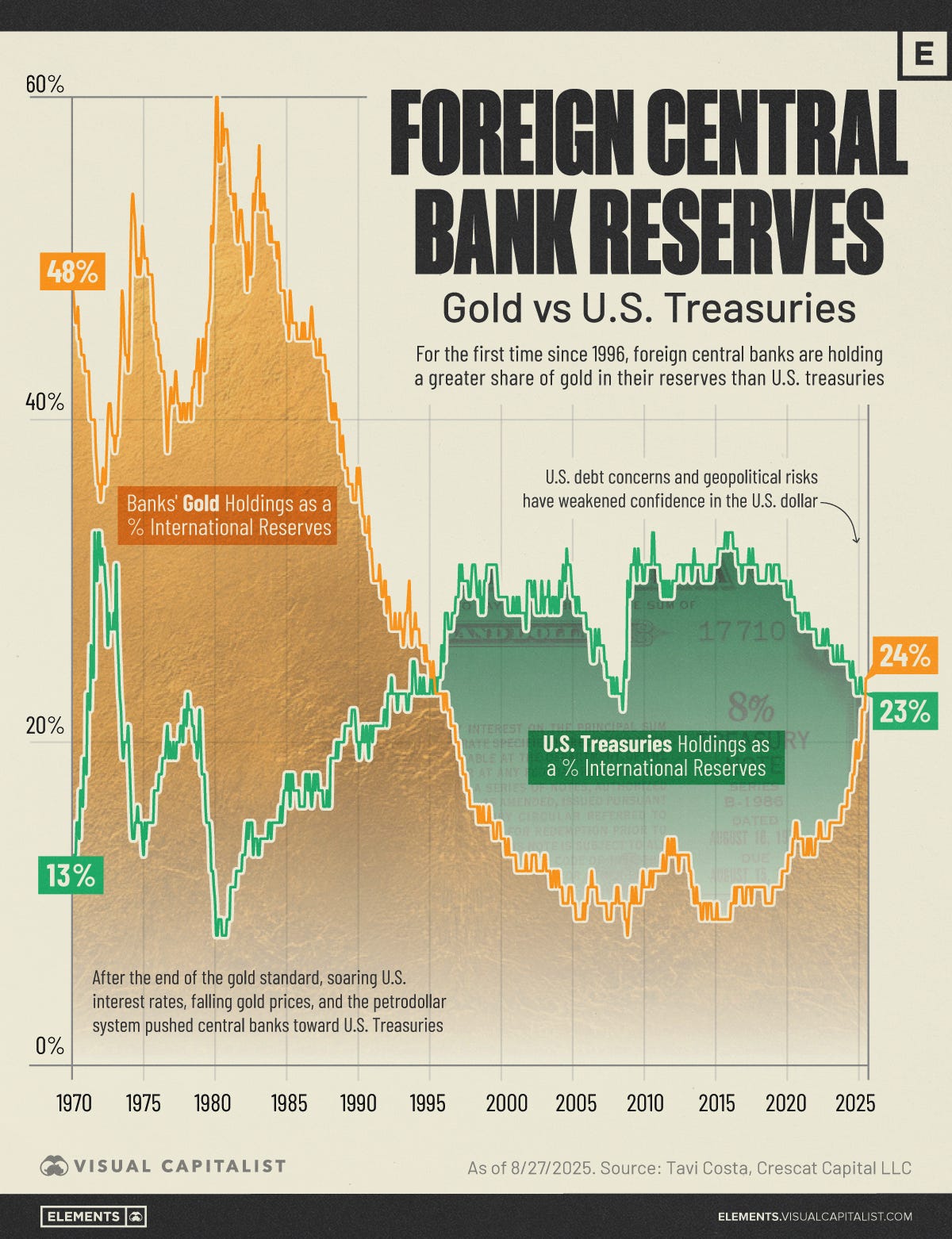

Just look at the headlines from the past 8 months — there has been a surge of “Gen Z” demonstrations across Africa and Asia, with thousands taking to the streets in countries from Morocco to Indonesia protest corruption, joblessness, and income disparities. Things are happening in the world that I didn’t think would happen until the mid-2030s — things like gold surpassing U.S. treasuries as the second largest reserve asset for central banks (something that hasn’t been true since 1996), China and Brazil signing an agreement to settle all trade in the two countries’ respective currencies, Israel seizing Gaza and bombing Iran, Azerbaijan seizing Nagorno-Karabakh, Russia teetering on geopolitical disaster after failing to conquer Ukraine, and more. In a multipolar world, assumptions about the sustainability of U.S. economic dominance collapses.

Challenges to hegemonic power, to fiat currencies, to central banks are proliferating by the day. Bitcoin’s market capitalization today is worth about $2 trillion, about the GDP of Brazil. Governments are taking positions: China and Turkey ban it for fear of the challenge it poses to their governments, while small countries like El Salvador and Bhutan embrace it in their own ways to punch above their weight. Heck, even the U.S. government is taking notice, whether by using stable coins in a vain attempt to extend U.S. reserve currency status or creating a strategic Bitcoin reserve. (That, to me, is an explicit admission that fiscal profligacy will continue, and Bitcoin has just become one of Washington’s ways to try hedge the purchase of more bread and circuses in the future.)

All of which is to say — I think there is a profound geopolitical case for Bitcoin building. I’ve been nervous to type those words because I think Bitcoiners will read this and think I’m too “normie” - whilst non-Bitcoiners will read this and think I’ve lost my mind. Indeed, it’s not often my fingers get as paralyzed as they have been on Bitcoin these past months, which has resulted in a quest to research more and more and more until I feel confident enough to declare a position on Bitcoin that is brilliant and well-sourced and unassailable. The fact is though that waiting for clarity has meant de facto ignoring what I see around me, and my conversation with Matt was powerful enough for me to say enough. I haven’t been “orange-pilled” yet but I also cannot deny a deep and unsettling feeling that multipolar acceleration is a powerful confirmatory signal of Bitcoin’s import and future.

So I don’t have the answers yet. But I do have three jumping off points for future analysis, which I expect I will return too often as I embark on an analytical journey to wrap my head around Bitcoin and its future.

Here They Are:

If you’re interested in politics or policy and you either don’t understand Bitcoin or dismiss it as a Ponzi scheme that is inherently worthless, you’re committing intellectual malpractice.

I’ve even started to wonder if Bitcoin itself qualifies as a geopolitical actor. It has a shared mythology, a global constituency, and a distributed infrastructure that transcends geography. It can’t sign treaties or wage war, but it can influence behavior, constrain governments, and express values through code.

It’s a network-state without borders, a self-organizing community of belief and verification. You buy Bitcoin because you think someone else will value it. That shared faith is what underpins every currency — and every nation — but unlike nations, where you have to trust your neighbor, Bitcoin works without trust at all, because it was made that way.

In that sense, Bitcoin is less a rebellion against states than a mirror held up to them. It shows what happens when belief in the old institutions wanes, and people begin to build new ones.

Bitcoin is unprecedented — there’s nothing like it in human history. Historical-based arguments that seek to understand Bitcoin will necessarily fail.

In a dollar-based world of infinite supply, Bitcoin represents a finite alternative. Every transaction on its network is verified by math, not by a middleman. It’s a financial system that doesn’t require you to “trust,” because verification is baked into the code.

If the 20th century was about national sovereignty — the power of states to determine their own destiny— maybe the 21st may be about personal sovereignty: the ability of individuals to hold, move, and secure wealth without permission.

As the price rises, attention and opportunism follow — so understanding how to protect and structure Bitcoin wealth is essential. For more on this dynamic, (Counter) Narrative has covered it in far more depth than I can. You can see more by clicking here.

Maybe the ultimate irony is that I have spent most of my 15-year career thus far studying how power works—only to realize that one of the most important revolutions in power might be happening outside the frameworks I was trained to use. Bitcoin doesn’t fit neatly into geopolitical theory because it’s not a state, not a commodity, and not quite a currency. (Maybe it’s all of them! Maybe it contains multitudes!6 Maybe Walt Whitman would have been a Bitcoiner!) It’s an idea made durable through code.

That’s also ultimately what the U.S. dollar is by the way — an idea. Which idea will the median voter like better if U.S. debt continues on its current path in 5 years?

At this point, I’m not primarily interested in winning debates or looking smart. I’m interested in understanding what actually protects and grows wealth—and it’s getting harder and harder to discount the possibility that one of the best answers to that question for the next 10+ years might be Bitcoin. I’m not ready to say it is the answer, not yet. But I’ve come a long way from where I started.

What strikes me most is how few serious geopolitical analysts (are there any besides me?) are saying the same thing. The people who trained me certainly aren’t on the same page. Maybe that means I’m off my rocker. Or maybe, as has often been the case in my career, it means I’m early. Being early and right on something usually looks like madness until everyone else catches up.

Bitcoin still feels heretical to the frameworks I was trained in, but so what? Cheeseburgers still feel heretical to me because I grew up keeping kosher but now I eat them with appetite and joy. In a world of depreciating currencies, exhausted institutions, and rising multipolar uncertainty, Bitcoin may be the most tangible expression of sovereignty left to individuals. “By means of mockery they attempted to laugh [Bitcoin] out of its position from which it could not be dislodged by any proofs supplied by reason.”7

So let’s start at the very beginning — “what I do not know I do not think I know either”8 — and see where we go from there.

https://www.cnbc.com/2018/06/15/geopolitical-analyst-george-friedman-says-blockchain-will-become-obsolete.html

https://www.balliol.ox.ac.uk/sites/default/files/politics_as_a_vocation_extract.pdf

I just had Matt back on the podcast two weeks ago — a must listen.

https://www.poetryfoundation.org/poems/45477/song-of-myself-1892-version

https://www.google.com/books/edition/Spinoza_s_Critique_of_Religion/dvDmq-eTZVYC?hl=en&gbpv=1&bsq=%22mockery%22

Plato, Apology, 21d

After listening to your latest podcast on bitcoin I suggest you might want to read "Attack of the 50 Foot Blockchain: Bitcoin, Blockchain, Ethereum & Smart Contracts" by David Gerard for the contrarian view of bitcoin and other crypto. In it he destroys most of the arguments made for bitcoin on the podcast.

He might be interesting to get on your show as well although if you are chasing bitcoin bros as clients then maybe not :)

Excellent analysis and welcome to the BTC community!

Have you heard of Balaji Srinivasin's (ex-Cointbase CTO) Network State Thesis? Sounds very similar to what you are trying to draw out here.

Here is a link to a podcast that he did outlining the thesis: https://open.spotify.com/embed/episode/2LGPBLSB3NKPL8Owa1TWM3

Lengthy but very good. Maybe a good future podcast guest for yourself.